Aadhaar Verification via OTP

Learn how you can digitally verify an individual’s Aadhaar using our APIs.

Aadhaar verification serves as identity and address verification. Apart from confirming that an applicant is an Indian citizen, Aadhaar allows you to verify details such as the applicant's name, gender, date of birth, father's name, and permanent address.

Typically Aadhaar verification is done while onboarding a customer as part of the know your customer (KYC) process. Integrating with ZWITCH APIs allows you to automate the KYC process, reducing the chances of human error.

Our Aadhaar Verification via OTP flow allows you to verify an individual's Aadhaar details by sending an OTP to the individual's mobile number. The individual can enter the OTP they receive on your system. In this flow, the individual is not redirected to any 3rd party service or hosted page. The individual interacts with your system, allowing you to customize the user experience per your design philosophy.

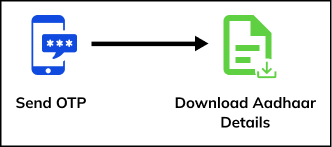

Workflow

With ZWITCH, you can verify an individual’s Aadhaar in 2 steps.

Aadhaar Verification Workflow

Follow the below steps to verify your customer's Aadhaar details.

-

Send OTP: An individual's consent is required to download their details from the Aadhaar database. You can initiate the process to obtain consent by sending an OTP to the individual's mobile number.

-

Download Aadhaar Details: If the individual consents to you downloading and using their Aadhaar details, they send you the OTP they received. Use the OTP to get their details from the Aadhaar database.

Use Cases

Traditional methods of KYC verification require your customer to visit your premises and submit self-attested copies of their identification documents. When you receive these documents you have to:

- Verify their authenticity against the original document.

- Manually convert the documents to a digital format and upload them to your servers.

This is a hassle for both you and your customer.

By integrating with ZWITCH, you can let your customers digitally verify documents and complete their KYC verification from your application. Digital verification:

- Reduce administrative costs

- Reduce paperwork

- Increase customer retention and,

- Lets you provide your customers with an enhanced user experience.

Neobanks and Fintechs

As a neobank or fintech organization, you build financial products for different segments of the population in different parts of the country. Asking your customers to visit your office to complete their KYC is not logistically possible and leads to customers dropping off your application. Non-compliance with RBI's KYC requirements could lead to your license being revoked.

With our digital KYC verification suite, you can let your customers complete the KYC process by verifying their PAN and Aadhaar from your application. You can also let customers schedule in-person KYC verification from your application, if required.

Investment Firms

As an investment firm, you offer multiple investment options to your customers including stocks, bonds, and mutual funds. These types of investments require you to open Demat accounts for your customers.

Opening a Demat account requires you to verify the customer's Aadhaar and PAN as part of the KYC process. You might also need to schedule in-person KYC for the customer.

Integrating with ZWITCH lets your customers complete their KYC process from your application. You can also help your customers schedule in-person KYC, if required.

Loan Providers

To avoid loan defaults it is important to ensure that you only onboard and give loans to honest customers. Apart from verifying the customer's Aadhaar and PAN details while onboarding customers, you will also want to physically verify their address.

Setting up a team to visit your customer's address is an additional expense for you and scheduling and organizing visits to your customer's address is an additional task for your team.

Integrating with ZWITCH not only lets you verify your customer's Aadhaar and PAN details, but also lets you schedule in-person KYC for the customer.

When we receive an in-person KYC request, we communicate with our in-person KYC partner who sends their agent to physically verify your customer's KYC documents and address.

Updated about 3 years ago