Transfers From Virtual Accounts

Learn how to transfer money from a virtual account to other bank accounts.

Unlike physical accounts, virtual accounts do not come with chequebooks or debit cards. The only way to transfer money from a virtual account is via an online transfer.

Online transfers provide a safe way for account holders to transfer money to their beneficiaries at any time, from anywhere. You can transfer money from your virtual account via transfer modes such as NEFT, IMPS, RTGS.

Prerequisite

To transfer money to an individual or entity, you must first add them as a beneficiary to your account.

Workflow

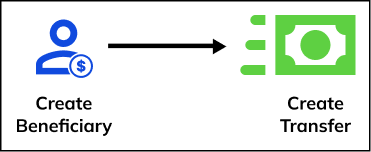

With ZWITCH, account holders can transfer money to an individual or an entity in 2 steps.

Transfer from VIrtual Accounts Workflow

Follow the below steps to make a transfer to an account.

-

[Prerequisite] Create a beneficiary: Use our Beneficiary APIs to add a beneficiary to the account. Virtual accounts support only bank account beneficiaries.

-

Create a transfer: In the case of transfers from virtual accounts, the transfer is directly sent to the bank for processing. There is no OTP required to authorize the transfer. Use our Create Transfers API to initiate a transfer from a beneficiary to the account.

Use Cases

Online transfers provide a safe and convenient alternative to traditional methods of payment such as cash or check payments. Online transfers allow you to transfer money to anyone, anywhere, and at any time. The money is credited to the beneficiary within a few hours.

You can use ZWITCH APIs to make transfers as low as ₹1 to bank accounts.

Vehicle Rental Company

As a vehicle rental company, you would take a security deposit before renting out a vehicle. To make payment reconciliation easier, you can create a virtual account for each customer. Customers transfer the security deposit to this virtual account.

When customers return the vehicle, you would have to transfer the security deposit back to them.

This requires transfers from the customer's virtual account wallet to their physical account via NEFT, IMPS, RTGS.

Limits and Timings

The table below are the bank timings and limits for the different transfer modes:

| Transfer Modes | Amount Limit | Processing Time |

|---|---|---|

| IMPS | Upto ₹5 lakhs (per transaction) | Credited immediately on all days 24x7. |

| NEFT | No limit | Credited within 2 hours between 8:30 a.m. and 6:30 p.m. on NEFT working days.* |

| RTGS | More than ₹2 lakhs (per transaction) | Credited within 30 minutes between 7:30 a.m. and 5:00 p.m. on RTGS working days.* |

- NEFT/RTGS working days - All days except 2nd and 4th Saturdays and Sundays and all NEFT/RTGS holidays.

Updated about 1 year ago